SERVICES

SFXCU Provide credit of tires, fertilizers and Agro-chemicals at zero interest for one year period.

For example, based on delivery of sugar cane at $3.00 per ton. So if one person delivers 300 tons of cane, the person is entitled to get 300 X $3.00 = $900.00 of credit in the product he/she requires. It is charged at a rate of $3.00 per ton on the delivery of sugar cane.

Also SFXCU provides this service to members as well under payroll which is deducted as a direct deduction from their salary in 1 year period to be covered. We do not charge a fee to make the loan nor interest.

We provide this services via companies like AgroVet Jiron, Prosser Fertilizer and Agro Tech and Caribbean Tire.

Contact us for more information.

NEW: SFXCU Residential Mortgage.

Where a NEW residential home is built, SFXCU will merit a 7.5% Fixed rate for the entire loan period.

Where a Loan Consolidation with existing Residential buy over, SFXCU will merit a 8.5% will be considered for the entire loan period.

For more information, visit our office and contact one of our loan officers.

We offer loans at different interest rates. Loans are for Agriculture, Marine products, Manufacturing, Tourism, Building and Construction, Real Estate and Personal Loans. Contact us for more information on our Loan process.

NEW: SFXCU WINGLE LOAN PROMOTION.

Saint Francis Xavier Credit Union Limited (SFXCU) has partnered with Caribbean Motor’s to offer a NEW WINGLE – Loan promotion. Under the agreement, SFXCU is now offering loans to provide 100% finance to it’s members who qualify under the program. Promotion also includes PUSH, PULL OR DRAG AND WINGLE MADNESS

Requirements to qualify for a NEW Wingle Loan:

- Be a member of SFXCU.

- Have an Active Account.

- Shares must be atleast 5% of the value of the Wingle Truck.

- Provide proof of Identity (Soc. Sec. card or passport)

- Proof of Address (utility bill within 3 months old)

- Proof of Income (recent job letter/income statement)

- Member in good standing at SFXCU.

- Be 18 years but not older than 60 years at the time of the loan aplication.

Salaried Individuals:

- This includes employees of private companies and Government employees.

- Individuals who have a minimum of 1 year with the current employer.

- Those who have payroll assignment to SFXCU.

NOTE: LOW MONTHLY PAYMENTS AND LOW INTEREST RATE.

For more information, visit our office and contact one of our loan officers.

SFXCU also now offers you the convenience to make your bill payments. You can make your Belize Telemedia bills, Electricity bills and BWS payments via us now at any branch.

Now also available at our Online Banking Service. Pay your bills.

A checking account is an account that allows our members to have easy access to their funds without physically coming to the credit union. Members who are 18 years of age, Business/Organizations in good standing are legible to apply.

Note a new account must be established for the member to be used as the Personal checking account (PCA). Check can be cashed at Heritage Bank; a fee will be charged by the bank per cashed checks. The checking account will be available for withdraws from the ATM.

Personal Checking account – Line of credit

SFXCU offers a Line of Credit to its members who qualify under the following terms:

- Member must have payroll assignment to SFXCU.

- All other Loans by the member must be up to date with their loan payments.

- A deduction of 10% of used Line of Credit will be deducted monthly from salary

- In the event, a member falls in arrears or becomes unemployed, SFXCU will have the authority to transfer from other sub accounts to cancel &.

- Credit line will be secured by member’s: shares/payroll salary

- Credit line amount will be determined by SFXCU

- Credit Line shall not be more than members’ monthly salary unless approved by management.

- Interest at the end of the month will be calculated on the unpaid credit balance.

Checking Account – Deposit savings account

- Checks from $2,000.00 and under can be cashed at any SFXCU office free of charge

- Fee will be charged for checks with NSF (insufficient funds)

Checking account – Overdraft (for business purpose only)

SFXCU offers overdraft facility to Company/Organization, businesses who qualify under the following terms:

- SFXCU offers an overdraft facility service for business purposes for Companies/Organizations who wish to have access to overdraft.

- The Overdraft Facility is being offered for operating businesses in good standing. A screening of the updated business account information will be done to assist SFXCU determine whether the account qualifies for an overdraft facility as well as to determine the amount to be approved.

- Overdraft will be paid monthly at 10 % minimum payment

- In the event, an overdraft facility falls in arrears for more than 3 months, SFXCU has the authority to suspend or cancel the overdraft facility. The company/organization will be required to clear any pending balance.

- Overdraft will be secured with account shares or any other collateral requested by SFXCU.

- Overdraft limit will be determined by SFXCU

- Interest at the end of the month will be calculated on used portion of overdraft

- If there is more than one signatory to the account, at least two will be requested to apply for this service.

About student Loan:

“Looking to finance your Junior college or university?” Now you can with our Student Loan Program. It is quick and easy to apply. You get a prompt response and your payment are affordable whereby you pay a monthly interest meanwhile you study. After 6 months from graduation, your regular loan payment will start.

To apply for the student loan, if you are not a member, then you need to come and open an account with us. You need to bring the following:

- a letter of acceptance and transcript.

- Estimated cost of fees from the institution.

- Copy of social security ID or passport.

- Utility bill to confirm address.

- Letter of income statement of parent and guarantors

- Have minimum shares of $30.00

SFXCU STUDENT GRANT REQUIREMENTS FOR 2023

- Student must be active member for a minimum of six (6) months and maintain a minimum shares balance of $30 as of January 2023.

- Student must present proof of promotion (Acceptance Letter or Promotion Report) and a copy of receipt for registration payment from High School or ITVET.

- Completed application forms must be enclosed in an envelope and address to:

The Administrator, St. Francis Xavier Credit Union Ltd., #79 Cor. 5th Ave. & 1st North, Corozal Town, Belize C.A.

Other things to note:

Approved Student Grants will be disbursed on Saturday, 29th July 2023 from 8:00 a.m. to 12 noon.

Student is required to present his/her SFXCU passbook and a valid Social Security Card or passport.

Deadline to submit completed application is July 26th, 2023.

Contact us for more information.

We at SFXCU now provide Digicell and Smart Top Up service.

St. Francis Xavier Credit Union Ltd, in improving our services to our members, proudly introduce our very own POS (Point of Sale) service. With your debit card you can now pay at any participating store or business country wide using our POS system. With most businesses participating all over the country of Belize, we at SFXCU are determined to help our members for a brighter future.

Available POS devices in Corozal:

- Doony’s Instant Loan Ltd.

- El Dorado Investment Ltd.

- Insurance Corp of Belize – Corozal Border.

- Insurance Corp of Belize – Corozal Town.

- Lydias Gift Shop.

- Nationwide Cash Express – Corozal Border.

- Nationwide Cash Express – Corozal Town.

- Princess Entertainment Free Zone.

Download our Point of Service (POS) countrywide listing here.

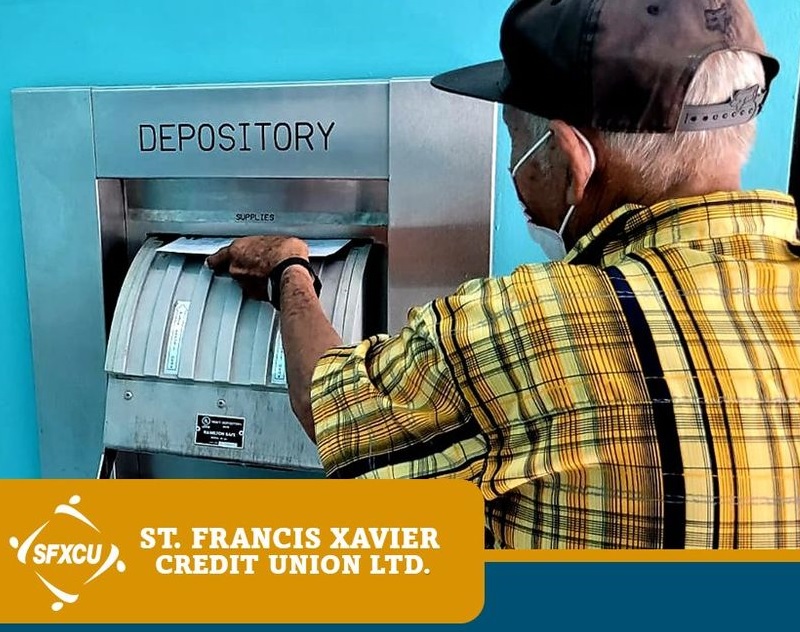

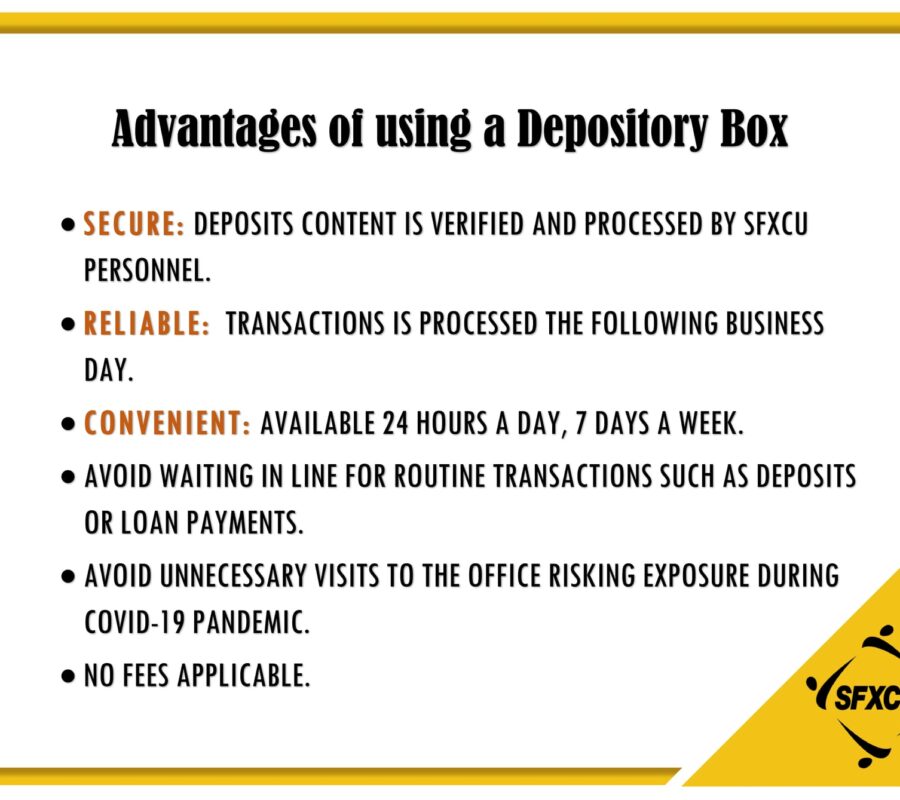

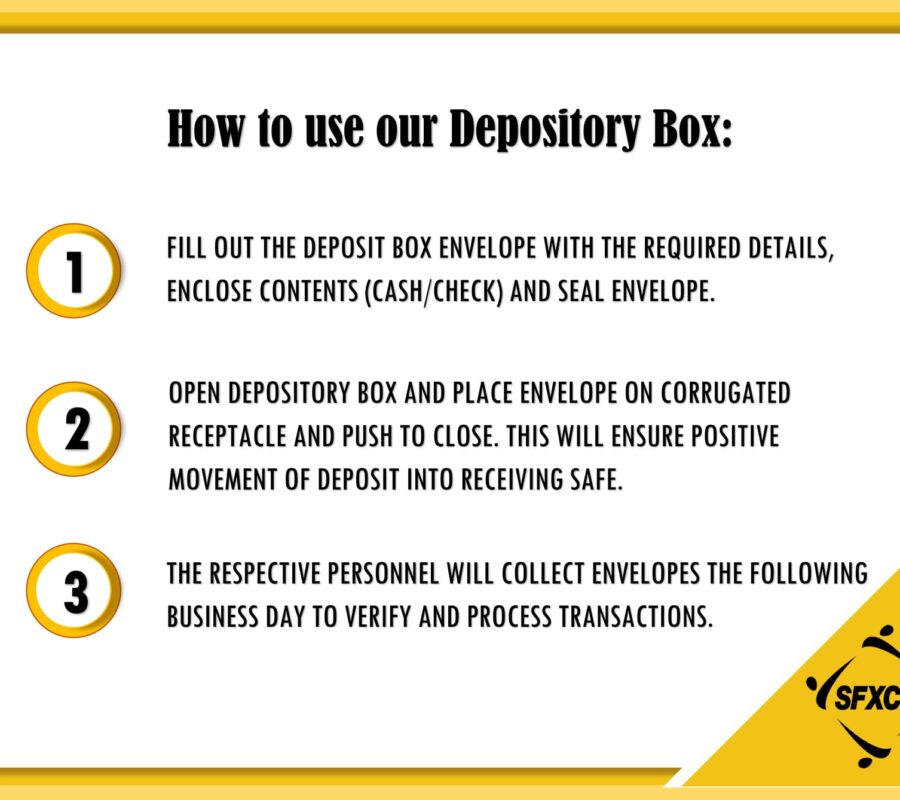

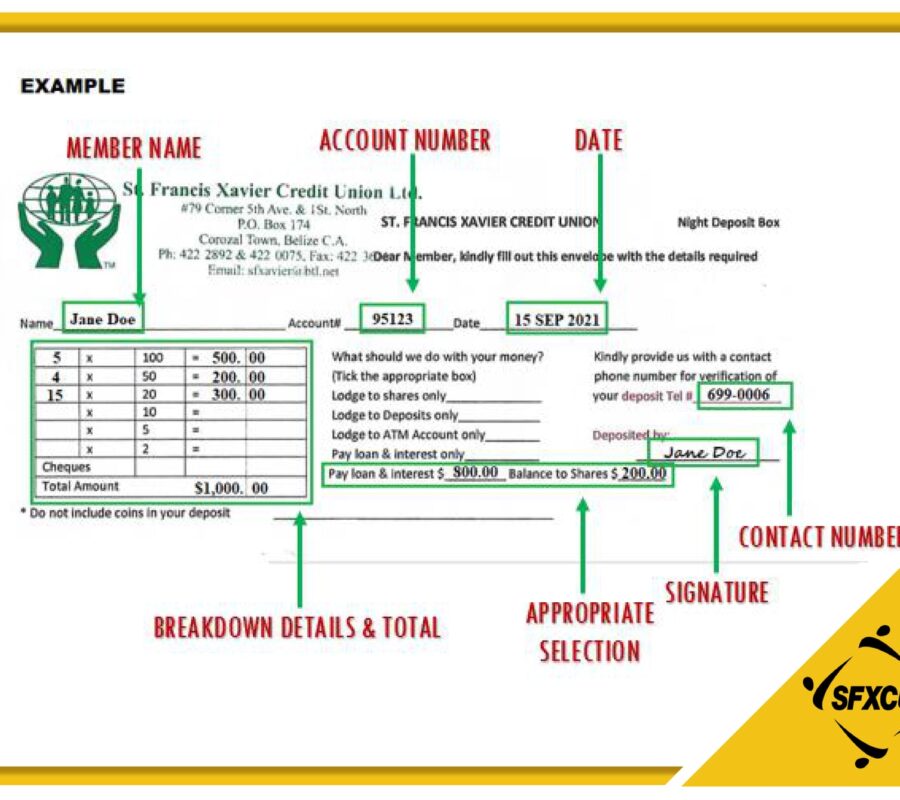

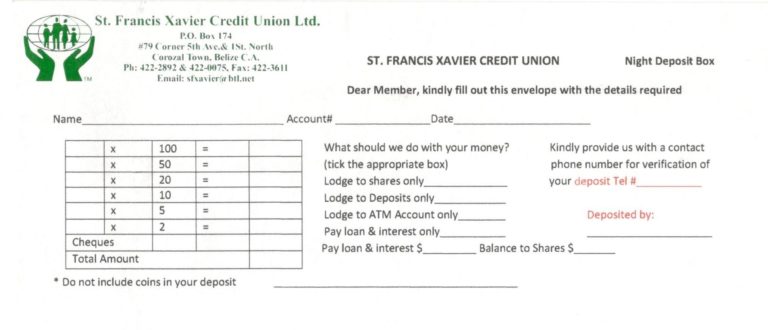

For member’s convenience, we also offer a Day/Night Depository Box. This service is located by the ATM Room and is a 24-hour Business service. All deposits to the drop box are processed the next morning and any deposits to the drop box during the day are processed after closing. It’s easy! Just fill-out the envelope found inside the tray and then drop inside.

Credit Union for Kids. Saving for a brighter future. Save everyday the Credit Union way.